Government warned of 'catastrophic' consequences for racing as it launches gambling tax consultation

Government plans to bring the taxation of all online gambling under one rate have been described as potentially "catastrophic" for British racing's finances by the Betting and Gaming Council (BGC).

The BHA also warned the proposals could have "significant" unintended consequences for both the economics of the sport and its workforce.

The Treasury on Monday launched a consultation titled 'The Tax Treatment of Remote Gambling' with proposals to harmonise all such wagering into a single tax to be called remote betting & gaming duty (RBGD).

General betting duty (GBD) is currently levied on all fixed-odds bets with a bookmaker, as well as pool bets on horse and greyhound racing, at a rate of 15 per cent of gross profits. The same rate applies to the separate pool betting duty.

However, remote gaming duty on games of chance such as roulette or bingo is levied at a rate of 21 per cent of gross profit and there are fears that harmonisation would inevitably result in the rate of GBD rising.

Such a move could have serious implications for British racing, leading to higher margins and worse value for racing punters, a further loss in turnover and therefore less income for the sport.

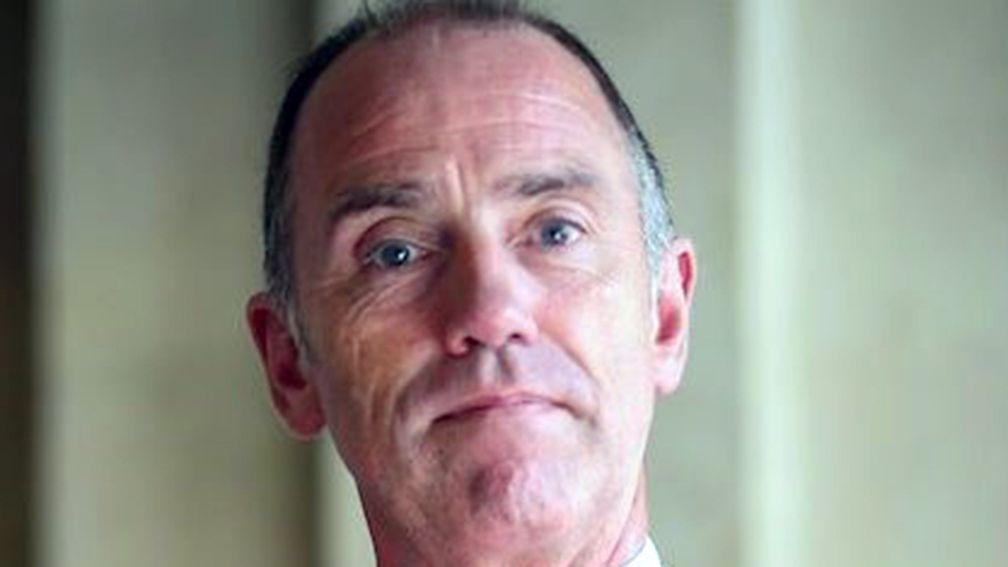

In his introduction to the consultation James Murray, exchequer secretary to the Treasury, said: "The time has come to consider moving to a single tax for UK-facing remote gambling. A single duty will provide tax certainty and increase simplification for remote gambling."

However, BGC chief executive Grainne Hurst warned that raising the rate through a single tax would be "utterly self-defeating for the government" and make a "mockery" of its growth strategy.

She said: "Any potential further increase in taxes on our members, so soon after a white paper which cost the sector over a billion pounds in lost revenue, will not raise more money for the Treasury. If general betting duty is raised to the same level as remote gaming duty under one new tax, it would be catastrophic for racing’s fragile finances.

"It will also likely force businesses to push investment and jobs overseas, while making their products more expensive for UK customers, driving them to the growing unsafe gambling black market online, which doesn’t pay a penny in tax and doesn’t have any of the safer gambling protections available in the regulated sector."

Hurst added: "Government must listen to business and sport and not drive growth, investment and jobs out of one of the UK’s few global business success stories."

BHA director of communications and corporate affairs Greg Swift said the governing body was pleased to have the opportunity to respond to the Treasury’s consultation "and will be working with stakeholders to build a strong argument and make sure that racing’s position is fully understood by the government".

He added: “We remain concerned about the prospect of tax harmonisation in gambling and believe that there could be significant unintended consequences for both racing’s finances and its workforce if government moves to a single duty."

The consultation, which was flagged in the government's spring statement in March, is set to run for 12 weeks and will close at midnight on July 21. Subject to responses to the consultation, the government said it would look to bring the new tax into effect in October 2027 at the earliest.

The government said the proposals for the new RBGD would harmonise the current regime into a single rate but added: "It is beyond the scope of this consultation to determine what that specific rate ought to be."

It added that should it proceed with the proposals, the rate will be set as part of the budget process. The new tax would not extend to premises-based gambling such as over-the-counter betting in betting shops.

Read these next:

Treasury did not consult DCMS on 'hammer blow' tax move - BGC

Culture secretary Lisa Nandy plays down tax rise reports and talks up horseracing industry

The Front Runner is our unmissable email newsletter available exclusively to Racing Post+ subscribers. Chris Cook provides his take on the day's biggest stories and tips for the upcoming racing every morning from Monday to Friday. Not a Racing Post+ subscriber? Join today

Published on inBritain

Last updated

- Consultation claims of exponential growth in remote gambling based on 'false comparison'

- Jockey arrested following car crash which has left passenger in hospital

- 'How do you propose that I live?' - emotional outburst of travelling head lad facing second ban for bad behaviour

- 'There would be no pressure and it's always been a dream of mine' - door open for Constitution Hill to run at Royal Ascot

- Field Of Gold hardens as 2,000 Guineas favourite after Aidan O'Brien rules out his main contender

- Consultation claims of exponential growth in remote gambling based on 'false comparison'

- Jockey arrested following car crash which has left passenger in hospital

- 'How do you propose that I live?' - emotional outburst of travelling head lad facing second ban for bad behaviour

- 'There would be no pressure and it's always been a dream of mine' - door open for Constitution Hill to run at Royal Ascot

- Field Of Gold hardens as 2,000 Guineas favourite after Aidan O'Brien rules out his main contender